Exports and imports

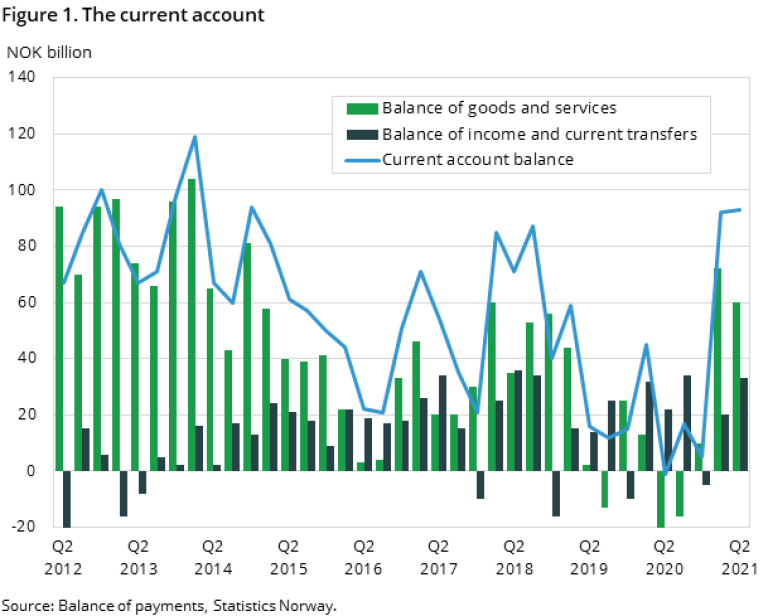

The surplus on the goods and services balance in the second quarter of 2021 was, like in the first quarter, very high with NOK 60 billion in surplus. The high prices of crude oil and natural gas persisted also in the second quarter and led to an export income of more than NOK 144 billion. This was about the same as in the previous quarter, but NOK 84 billion more than the same quarter in 2020. The high export income from oil and gas resulted from higher commodity prices rather than volume, which was almost the same as in the previous quarter. The freight income in shipping improved much in the second quarter and contributed to the positive development in the balance of services.

There are particular circumstances that have led to a higher balance of services during the coronavirus pandemic, namely the strict travel restrictions; there is a sharp decline of both exports and imports of travel. The imports of this item consist, put simply, of all costs Norwegians face when traveling abroad. The exports are the opposite. As an illustrative example we could say that the imports of this item is about NOK 33 billion a quarter on average. The export is NOK 11 billion. This means that we would have an improvement of NOK 22 billion a quarter on average on the balance of services if we exclude travel in the account. During the pandemic most travel abroad stopped both out of the country and in to the country, and this has caused an improvement for net lending of more than NOK 100 billion so far.

Total exports ended at NOK 350 billion in the second quarter of 2021, which is NOK 13 billion higher than in to the previous quarter and NOK 111 billion more than in the same quarter in 2020. Beside oil and natural gas, refined petroleum products, metals and electricity also contributed to the growth in export income. Exports of services are registered at about NOK 85 billion in the second quarter of 2021. Increased ocean transport accounts for most of the growth in export income.

Total imports in the second quarter of 2021 increased by almost NOK 25 billion measured against the previous quarter and registered at about NOK 289 billion. The sharp growth was primarily driven by a rise in imports of cars, machines, metals, and refined petroleum products. A slightly weaker NOK is also contributing to higher import prices.

For more information about exports and imports, including price and volume considerations and seasonal adjustments, please see the quarterly national accounts.

The balance of income and current transfers

Preliminary calculations of the balance of income and current transfers amounted to NOK 33 billion in the first quarter of 2021. This is more than NOK 11 billion higher than in the same period in 2020 and NOK 13 billion higher than the figures for the first quarter of 2021. Norway's total income increased by NOK 21 billion, while the corresponding total expenses increased by almost 8 billion, both measured against the first quarter of 2021. A more detailed review reveals that net dividends is the strongest contributor to the growth. This applies to both direct investment dividends and portfolio dividends. Net income on direct investments in the second quarter of 2021 was NOK 17 billion, which is high while net portfolio dividends of NOK 52 billion is a record high. A negative net reinvested earning of NOK 22 billion is however curbing the growth of the balance of income and current transfers.

Norway's current account balance is estimated to be just above NOK 93 billion in the second quarter of 2021, which is slightly higher than in the first quarter. For the first six months of the year the current account balance was NOK 184 billion, which is the highest half-year result since 2014.

The financial account

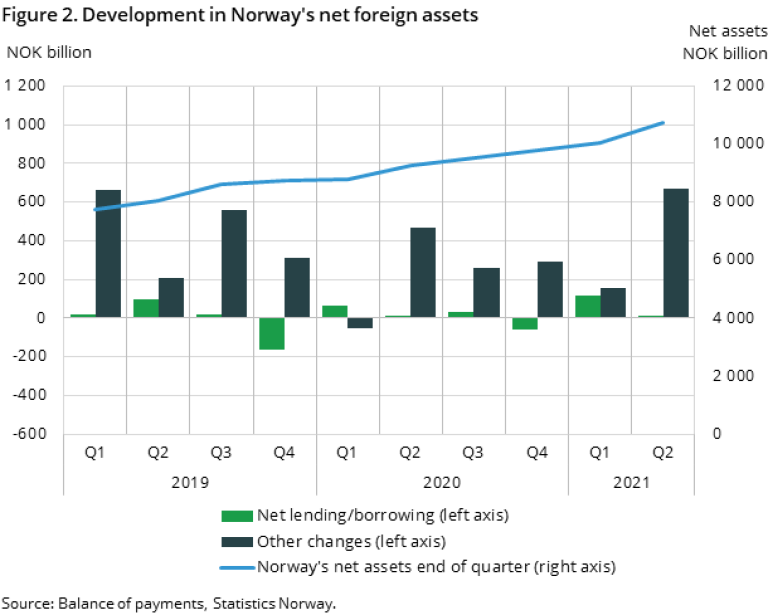

Norway’s net foreign assets increase by NOK 681 billion from the previous quarter, making a total of NOK 10731 billion. The figure below shows a steady increase over several quarters.

Other changes

As in the first quarter of 2021 the main financial force in strengthening the Norwegian foreign assets is market price changes, but it’s impact on this quarter is definitively more substantial. The value of Norway’s foreign portfolio investments increased by NOK 777 billion, making the investments a total of NOK 14236 billon. The rise in global stock markets and The Government Pension Fund Global activities in portfolio investments are explanations for this positive change, where the Fund alone had an increase of NOK 506 billion in market price changes. Furthermore, the Norwegian krone depreciated during the second quarter resulting in positive exchange rate changes.

Financial transactions

In the previous quarter net lending had a substantial impact on Norway’s net foreign assets, whereas for this quarter net lending had a minimal impact on the increase in net foreign assets, with only NOK 11 billion. Financial institutions such as banks and insurance companies were sectors, of importance, with net positive financial transactions. On the other hand, we have net borrowing caused by private entities.

Good data capture and quality

Many parts of the economic statistics have been affected by the corona pandemic, and the uncertainty is unusually high. However, the international accounts seem to have been less affected. Providers of primary data have been able to collect the necessary information according to the planned schedule, and the data quality seems satisfactory. The uncertainty about the foreign accounts for the second quarter of 2021 does therefore not seem to be greater than usual.

The current account figures are revised only for first quarter of 2021. The financial account has been revised back to the first quarter of 2019.