Exports and imports

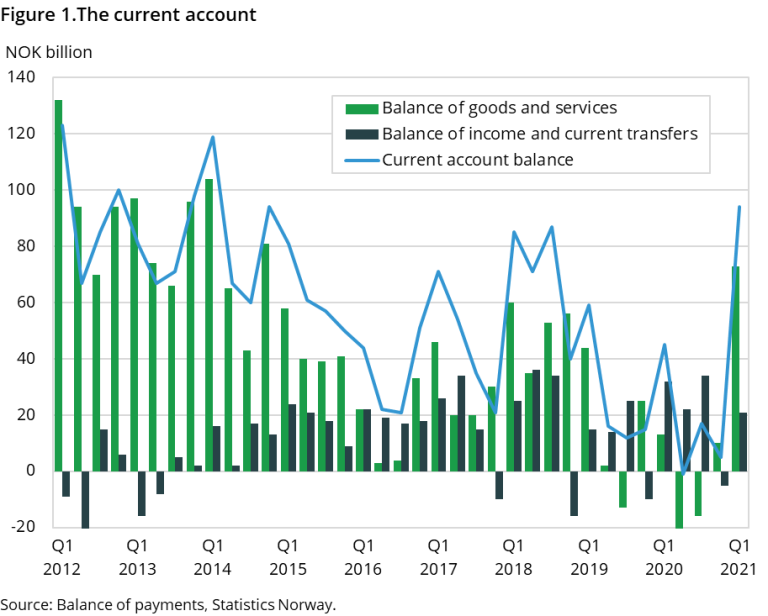

The surplus on the goods and services balance in the first quarter of 2021 was the highest since 2014. After a longer period of lower revenues, export revenues on crude oil and natural gas improved slightly in the first quarter of 2021 and amounted to NOK 143 billion. This is an increase of NOK 38 billion from the same period last year, which represents an increase in value of over 36 percent. Despite this, there was a decline in the export volume of crude oil and natural gas in the same period. The increase can consequently be attributed to higher prices for crude oil and natural gas exports.

Total exports of goods were NOK 257 billion in the first quarter of 2021, which is NOK 40 billion higher than in to the previous quarter as well as the same quarter in 2020. Exports of services are registered at about NOK 79 billion in the first quarter of 2021, almost NOK 15 billion lower than in the first quarter of 2020. As in previous quarters, the decline in travel and passenger transport is most important for the total decline in export of services.

Total imports in the first quarter of 2021 decreased by almost NOK 35 billion measured against the same quarter in 2020 and registered at about NOK 263 billion. The sharp decline was, as in previous quarters, primarily driven by declines in travel as a result of global travel restrictions. But there was also a significant decline in financial- and business services.

For more information about exports and imports, including price and volume considerations and seasonal adjustments, please see the quarterly national accounts.

The balance of income and current transfers

The balance of income and current transfers amounted to NOK 21 billion in the first quarter of 2021. This is more than NOK 11 billion lower than the same period in 2020 but higher than the figures for the fourth quarter of 2020. Norway's total income decreased by NOK 19 billion, while the corresponding total expenses decreased by 7 billion, both measured against the first quarter of 2020. A more detailed review reveals that on the income side, income from interest weakens considerably, measured against the first quarter of 2020, especially for investments made by Government Pension Fund Global. Dividend payments in the same period had a slight increase, perhaps driven by the fact that many Norwegian companies opted to not pay dividends to their shareholders, while the same was not the case the other way around. On the expenditure side, there was a decline in both interest and dividend payments. Net compensation of employees and investment income from abroad amounted to approximately NOK 31 billion for the first quarter of 2021.

Norway's current account balance is measured at just above NOK 94 billion in the first quarter of 2021. We must go seven years back, to the first quarter of 2014, to find a higher current account balance. However, disregarding the trade in crude oil and natural gas, there was a deficit of NOK 49 billion, which was the largest deficit since the first quarter of 2016.

The financial account

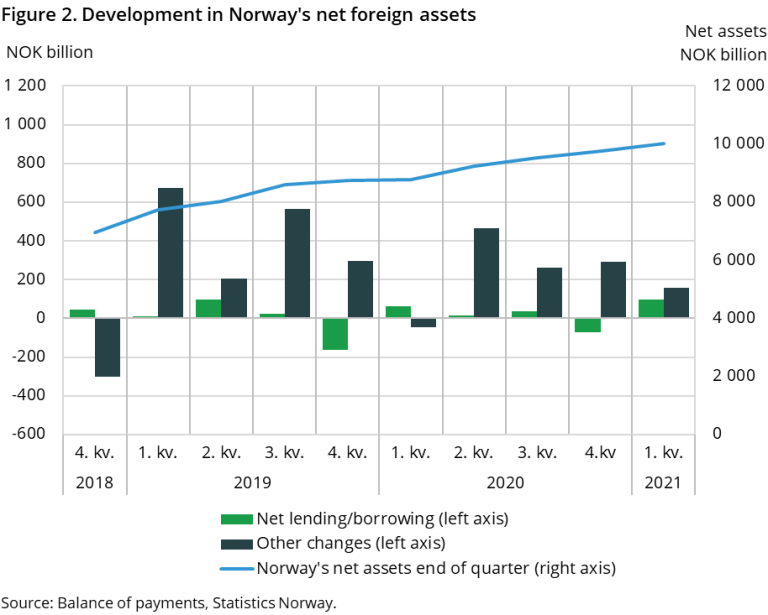

During the first quarter of the year, Norway’s net foreign assets exceeded NOK 10 000 billion. The financial account shows net foreign assets amounting to NOK 10 018 billion. This was an increase of NOK 254 billion from the end of 2020.

Both other changes, which consists of market price changes and exchange rate changes, and financial transactions, contributed to the increase.

Other changes

A substantial part of Norways’ assets are placed in listed shares, and positive market price changes for shares was the main driving force behind the strengthening of Norways net assets in the 1st quarter of 2021. At the same time, the NOK appreciated during the quarter, having an opposite effect on Norways’ assets through negative exchange rate changes. However, the appreciation of NOK is also positive for Norway, in the sense that Norways debt issued in foreign currency becomes less worth.

Altogether, net other changes amounted to NOK 156 billion.

Financial transactions

Financial transactions also increased Norway’s net foreign assets this quarter, the financial account showed net lending of NOK 97 billion. Other investments abroad, such as deposits, short- term loans and other accounts receivable, contributed the most.

Good data capture and quality

Many parts of the economic statistics have been affected by the corona pandemic, and the uncertainty is unusually high. However, the international accounts seem to have been less affected. Providers of primary data have been able to collect the necessary information according to the planned schedule, and the data quality seems satisfactory. The uncertainty about the foreign accounts for the first quarter of 2021 does therefore not seem to be greater than usual.

The current account: Figures are revised for all the quarters in 2020. Exports for 2020 have been adjusted upwards by just over NOK 7 billion. This revision is mainly due to new price information on exports of crude oil and natural gas, as well as adjustment of travel expenses. Imports have been adjusted upwards by more than NOK 2 billion. Here it is a more mixed picture: among other things, imports of operating services and investments in the oil sector have been adjusted down by NOK 4 billion after new information became available, while new information concerning the estimation of the level in trade in services has led to an upward adjustment of NOK 7 billion. Revenues from abroad have been revised upwards by just under NOK 1 billion for 2020 in total, while expenditures have been adjusted upwards by around NOK 4 billion. On the expenditure side, new information is available on dividends paid by Norwegian oil companies to foreign shareholders, as well as new information on reinvested profits. The financial account has been revised back to the first quarter of 2020.