Content

Published:

This is an archived release.

Paid out dividends at same level as last year

Dividend payouts from enterprises registered with the Norwegian Central Securities Depository (VPS) were at the same level as last year. Two thirds of total dividends were paid out by private and state-owned non-financial enterprises.

| 3rd quarter 2015 | 4th quarter 2015 | 1st quarter 2016 | 2nd quarter 2016 | |

|---|---|---|---|---|

| Stocks (market value) | ||||

| Shares (listed) | 1 751.7 | 1 827.2 | 1 733.7 | 1 812.9 |

| Shares (unlisted) | 443.3 | 433.4 | 433.2 | 427.6 |

| Long-term debt securities issued in Norway | 1 756.0 | 1 735.2 | 1 770.8 | 1 811.3 |

| Short-term debt securities issued in Norway | 166.9 | 170.4 | 182.3 | 177.0 |

| Equity certificates | 28.0 | 31.3 | 31.4 | 34.0 |

| Dividends/coupon payments | ||||

| Shares (listed) | 7.3 | 13.4 | 6.8 | 43.8 |

| Shares (unlisted) | 1.3 | 0.4 | 2.9 | 8.8 |

| Long-term debt securities issued in Norway | 9.0 | 10.1 | 10.9 | 21.5 |

| Short-term debt securities issued in Norway | 0.3 | 0.3 | 0.3 | 0.4 |

| Equity certificates | .. | .. | 0.2 | 1.0 |

The second quarter is still the quarter in which most of the dividend payouts are made despite corporations being allowed to pay out several times a year from 2014 following a change in legislation. While some enterprises have started to pay out dividends several times a year, dividends in the second quarter of 2015 were still twice as high as in the other three quarters combined.

In the second quarter of 2016, dividends on all shares and equity certificates registered with the VPS amounted to NOK 53.7 billion. This is NOK 3 billion higher than in the same quarter of last year. Of these dividend payouts, NOK 42.5 billion was from listed Norwegian enterprises – exactly the same amount paid out last year. Unlisted enterprises paid out NOK 8.3 billion in the second quarter, NOK 3 billion more than in the same quarter of 2015. Local banks’ payouts of dividends to owners of equity certificates amounted to NOK 1 billion; NOK 0.2 billion less than last year.

Private and state-owned enterprises pay out two thirds of dividends

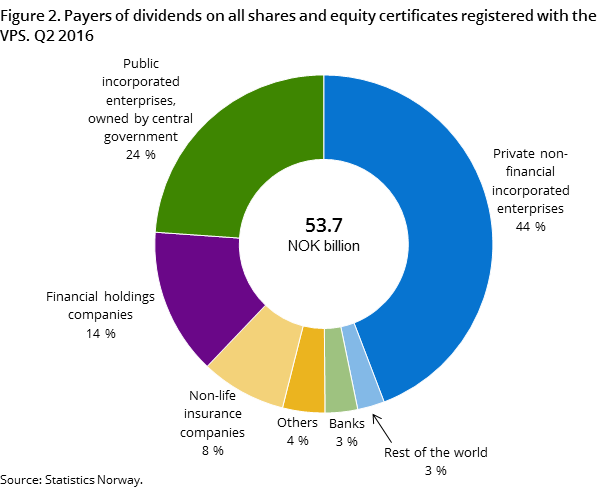

Dividend payouts from private non-financial incorporated enterprises and public incorporated enterprises owned by central government amounted to NOK 23.7 billion and NOK 12.8 billion, equivalent to a share of 44 and 24 per cent respectively of total dividend payouts. Combined, enterprises in these two sectors accounted for two thirds of all dividend payouts. Foreign-registered enterprises only paid out 3 per cent of total dividends. Foreign-registered enterprises’ share of dividends has fallen significantly in the last few years.

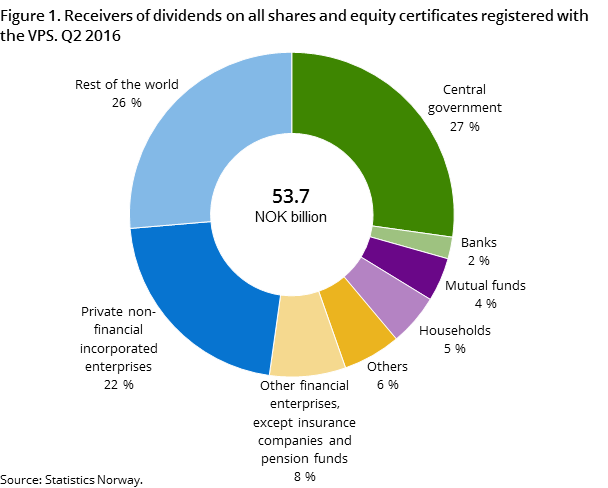

Central government received the highest share of dividends, with 27 per cent or NOK 14.6 billion. Foreign investors received the second highest share of dividends, with 26 per cent, while households took approximately 5 per cent, NOK 2.8 billion.

Non-life insurance companies and financial holding companies increase dividend payouts

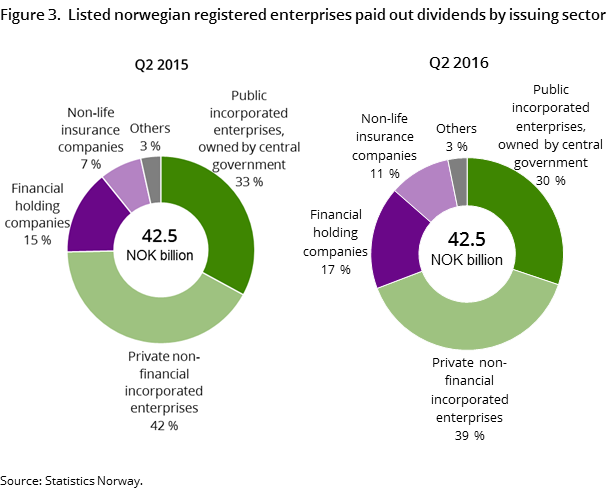

Listed Norwegian-registered enterprises paid out NOK 42.5 billion in both the second quarter of last year and second quarter of this year. Of these, non-life insurance companies and financial holding companies increased their share of the dividend payouts in the second quarter. This is partly due to the five corporations that pay out the most in dividends having increased their dividends from 2015 to 2016.

Positive development in the stock market in the second quarter

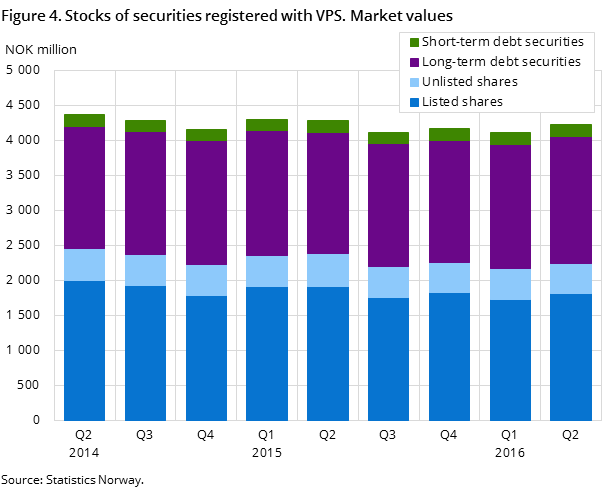

Total market value of all VPS-registered listed shares increased by NOK 79 billion, or 4.6 per cent, in the second quarter of 2016. The increase in value is mainly due to rising prices of securities in the Oslo Stock Exchange. The Norwegian equity market had a positive development in the second quarter of this year – as did many other markets around the world – after a turbulent start to the year. The stock index OSEAX, which measures listed shares, increased by 6.0 per cent to 666 points in this quarter. The larger increase in the index is due to an adjustment for dividend payouts and capital events.

Decreasing effect from weakened currency

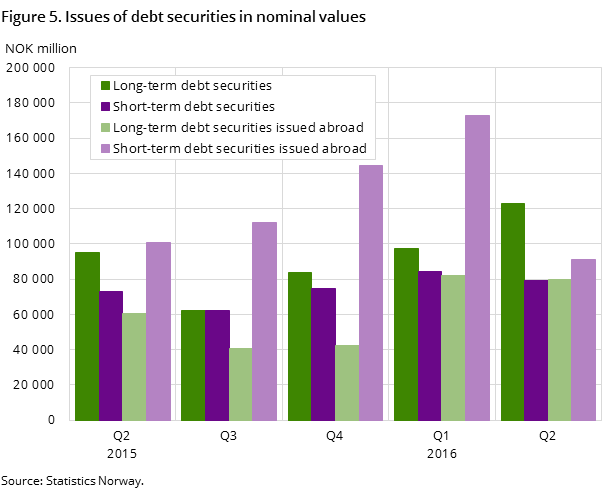

At the end of the second quarter of 2016, the face value of outstanding debt securities issued in Norway stood at NOK 1 975 billion; an increase of 5.6 per cent compared to the second quarter of last year. In the same period, outstanding short and long-term debt securities issued abroad increased by 5.4 per cent to NOK 1 807 billion at the end of the quarter. The growth of outstanding debts during the last twelve months can still be attributed to the effect of a weakened NOK currency relative to other currencies. This effect has, however, been decreasing of late, and only marginally affected the level of debts in the second quarter.

Contact

-

Steven Chun Wei Got

E-mail: steven.got@ssb.no

tel.: (+47) 90 82 68 27

-

Ole Petter Rygvold

E-mail: ole-petter.rygvold@ssb.no

tel.: (+47) 47 27 23 62

-

Harald Stormoen

E-mail: harald.stormoen@ssb.no

tel.: (+47) 95 91 95 91