Content

Published:

This is an archived release.

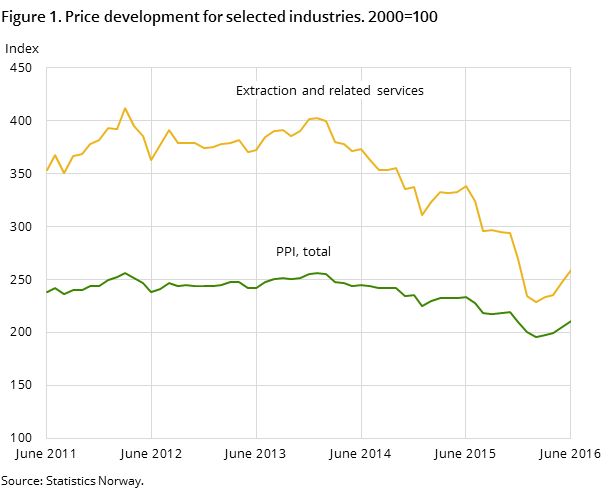

Energy goods pulled up the PPI

The producer price index (PPI) continued its upward trend as it rose for the fourth month in a row. Higher prices on energy goods were behind the rise. The prices of crude oil, natural gas, electricity and refined petroleum products all went up from May to June.

| Industrial Classification | Index change in per cent | Index | Weights1 | |

|---|---|---|---|---|

| May 2016 - June 2016 | June 2015 - June 2016 | |||

| 1The weights are updated annually, and are valid for the entire year. | ||||

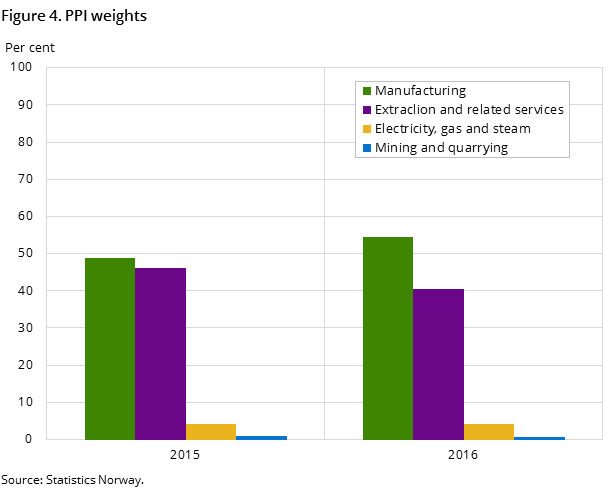

| Extraction, mining, manufacturing and electricity | 2.8 | -9.7 | 210.3 | 1 000.0 |

| Extraction and related services | 4.7 | -23.5 | 258.7 | 405.4 |

| Mining and quarrying | 0.6 | 3.2 | 178.7 | 7.6 |

| Manufacturing | 1.1 | -0.7 | 159.9 | 544.6 |

| Food products | 0.1 | 7.3 | 177.3 | 117.0 |

| Refined petroleum products | 7.3 | -11.6 | 172.5 | 79.1 |

| Basic metals | 0.1 | -11.9 | 169.9 | 45.7 |

| Machinery and equipment | 0.0 | 4.1 | 158.9 | 59.2 |

| Electricity, gas and steam | 8.2 | 53.3 | 249.5 | 42.4 |

PPI rose 2.8 per cent from May to June. This was the biggest rise from one month to another since 2010. The most important contributor to this was the prices of crude oil and natural gas, which went up 6.1 per cent. As with the PPI total, this was the fourth month in a row with a price rise for crude oil and natural gas as a whole. In June, the price of oil was at its highest level this year, which contributed to the PPI also reaching its highest level in 2016. This is still well below the record high in January 2014, when the price of oil was over $100 per barrel.

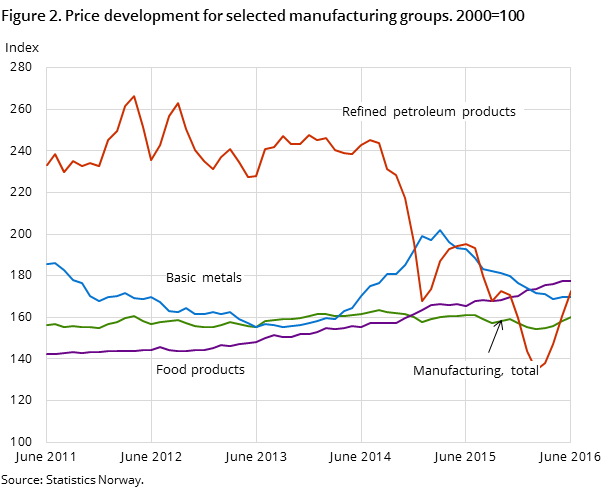

Price rise on electricity and refined petroleum products

Prices of electricity went up 8.2 per cent from May to June, and were therefore at their highest level since January this year. In addition, the prices were 53.3 per cent higher than June last year, when electricity prices were historically low. The last time that prices in the month of June were higher was in 2011.

The prices of refined petroleum products rose from May to June, and are thus following the price increase in crude oil. This is the fourth month in a row with a price increase for refined petroleum products where products such as gasoline, kerosene and other fuels are important item groups.

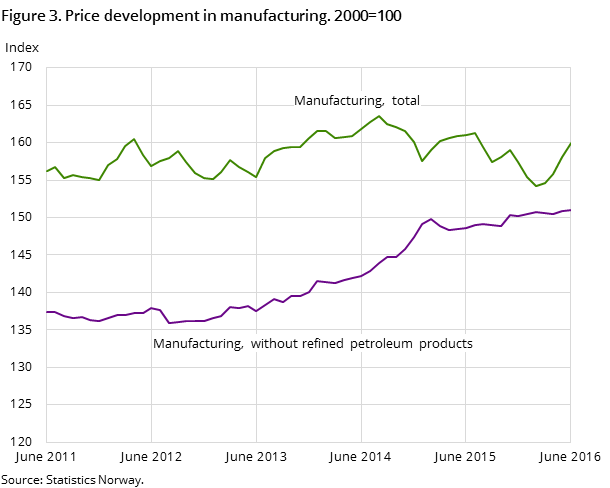

Small price changes for the manufacturing industry

For the manufacturing industry as a whole, the prices went up 1.1 per cent, but this rise was mainly driven by the price rise for refined petroleum products. If this group is excluded, the price increase for the manufacturing industry was 0.1 per cent. The group of goods that had some price changes include basic chemicals and non-metallic mineral products. The former had a price rise of 1.2 per cent, while the latter had a price drop of 0.7 per cent.

Price rise in the domestic market since same time last year

The change in the PPI total from June 2015 to June 2016 (the twelve-month change) was minus 9.7 per cent. The drop is mainly driven by the prices of crude oil and natural gas, which fell 27.2 per cent during that period. However, the twelve-month change in the domestic market was positive at 1.2 per cent. This is because crude oil and natural gas are mainly exported, which means they do not impact the domestic market price level as much. The increase in electricity prices from June last year was the main contributor to the price rise in the domestic market.

Additional information

Contact

-

Producer price index

E-mail: produsentpris@ssb.no

tel.: (+47) 21 09 40 00

-

Elisabeth Mælum

E-mail: elisabeth.maelum@ssb.no

tel.: (+47) 97 01 28 49

-

Morten Madshus

E-mail: morten.madshus@ssb.no

tel.: (+47) 40 90 26 94

-

Monika Græsli Engebretsen

E-mail: monika.graesli.engebretsen@ssb.no

tel.: (+47) 40 90 23 71

-

Håvard Georg Jensen

E-mail: havard.jensen@ssb.no

tel.: (+47) 40 90 26 86