Content

Published:

This is an archived release.

Minor reduction in national income and saving for Norway

A main revision of the Norwegian national accounts has lifted the GDP level but reduced national income and saving for Norway. The revisions were undertaken as a result of updated international guidelines on definitions and methodology, as well as new statistical information.

In line with other countries, Norway adheres to the international guidelines on national accounts. These guidelines have recently been updated and include a requirement by the EU's statistical agency, Eurostat, for the European System of National and Regional Accounts 2010 (ESA 2010) to be incorporated into the member states and other EEA countries' national accounts by autumn 2014.

Aggregated figures for Norway

The most important definition-related changes due to the new international guidelines are that research and development (R&D) services and major military procurements are now recognised as investments and not as current operating expenses. This means that the absolute level of GDP and gross national income (GNI) has been lifted compared to the old figures. However, since the consumption of fixed capital has increased even more, the national income of Norway has been revised downward. Total final consumption expenditures, however, have also been revised down, resulting in a small revision to Norway’s saving.

Other changes have also been implemented in this main revision of the Norwegian national accounts. Both new sources and new methods of estimation have been introduced in some areas.

The figures for the period 1995–2012 are final, while the figures for 2013 are still provisional. Figures dating back to 1978 will be published in February 2015 in conjunction with the publication of quarterly national accounts for the 4th quarter of 2014.

Table: Production and income. Main figures for Norway. 2011. NOK billion.

Households and Non-Profit Institutions serving Households (NPISHs)

For households and NPISHs, the revisions for 2011 have resulted in a downward adjustment of disposable income from NOK 1 187 billion to NOK 1 128 billion. Also taking into account the adjustment for households’ saving in pension funds, the downward revision is smaller. Final consumption expenditures are also revised down to some degree, leaving the sectors’ saving in 2011 at NOK 75 billion; down NOK 18 billion compared to the old figures. Net lending has been revised down by NOK 19 billion to NOK 5 billion, see the table "Main results for Households and NPISH’s. 2011. NOK billion".

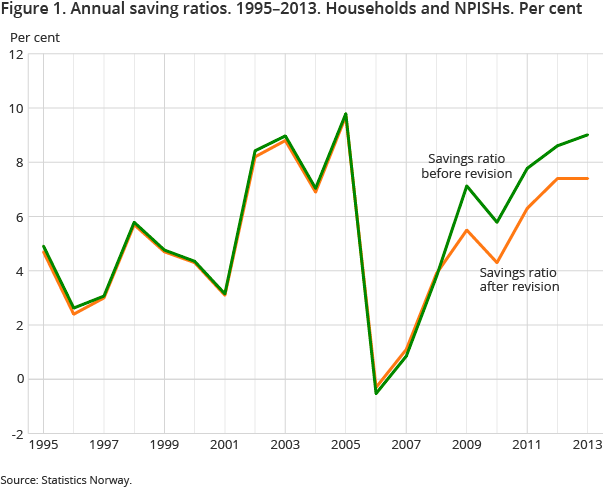

The revisions in disposable income and saving mean that the savings ratio of the sectors is also affected. For 2011, the savings ratio of Households and NPISHs is revised down from 7.8 per cent to 6.3 per cent.

Figure 1 shows the annual saving ratios before and after the main revision from 1995 onwards.

The statistics is now published as National accounts, non-financial sector accounts.

Additional information

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42