Non-financial and financial accounts in institutional sector

Published:

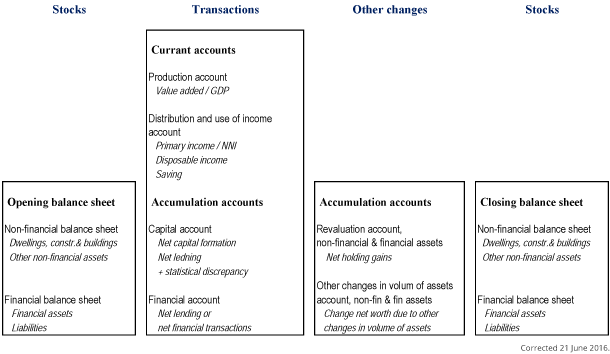

The institutional sector accounts give a general statistical description of the main sectors in the Norwegian economy. Figure 1 gives an overview of the sector accounts, which comprise all types of accounts in the national accounts system from production accounts to balance sheets.

The data in table 11123 in Statbank is assembled from released statistics from the non-financial and financial accounts. The table comprises annual statistics. Users who require more detailed statistical information than that provided in table 11123 should follow the links below:

2. Institutional sectors

Principles and definitions in the Norwegian national accounts system are based on the recommendations in the international manuals for national accounts: System of national accounts (SNA 2008, FN) and European system of accounts (ESA 2010, Eurostat).

The institutional sector accounts in table 11123 comprise five aggregated institutional main sectors.

• S11 Non-financial corporations

The non-financial corporations sector comprises all private and public corporate enterprises that produce goods or provide non-financial services to the market.

• S12 Financial corporations

The financial corporations sector comprises all private and public entities engaged in financial activities. The activities comprise financial intermediation (e.g. banks and mortgage companies), investment funds and insurance corporations and pension funds. The sector also comprises entities engaged in auxiliary financial activities. Among them we find brokers, fund managers, market administrators and head offices with subsidiaries that are financial corporations.

• S13 General government

The sector comprises central and local governmental units that carry out political responsibilities, provide and enforce regulations, produce public services (mainly non-market) and redistribute income and wealth. The Government Pension Fund is included in the sector.

• S14 Households and S15 Non-profit institutions serving households

The households sector comprises all domestic households and household business activities. Inter alia the activities to unincorporated enterprises and partnerships that do not have an independent legal status. The property in tenant-owners associations is regarded as owner-tenant property and the tenant-owner associations are therefore included in the households sector. Non-profit institutions serving households are grouped together with households in table 11123. The sector comprises sports clubs, associations, voluntary organisations and foundations that are engaged in non-market production and provide services or benefits to households.

• S2 Rest of world

The sector comprises all foreign units that carry out transactions or have financial economic relations with domestic institutional units.

3. System of accounts

Table 11123 provides a complete set of accounts for each of the five institutional main sectors. Transactions are classified in two categories of accounts; current accounts and accumulation accounts. The remaining accumulation accounts show other changes in balance sheets. Thus accumulation accounts explain all the changes in the balance sheet during a year. Balance sheets record the value of assets and liabilities at a particular point in time, for instance at the end of the year.

• Current accounts

The production account is the first of the transaction accounts in non-financial accounts. The production account shows the transactions relating to the production of goods and services for a sector. Resources refer to output and taxes less subsidies on products, and uses refer to intermediate consumption. The balancing item of the production account is value added. The sum of gross value added over all domestic sectors plus taxes less subsidies on products is equal to the Gross Domestic Product (GDP) of the economy as a whole, at market prices.

The balancing item of the generation of income accounts shows the acquired surplus in production of goods and services. The balancing item consists of mixed income, which accrues to self-employed households, and operating surplus, which mainly accrues to corporations. The allocation of primary income account records incomes that accrue to resident institutional units as a consequence of their involvement in processes of production or ownerships of assets that may be needed for purposes of production. Primary incomes thus include income from production and financial incomes in the form of interests and dividends. For the economy as a whole, this adds up to Net National Income (NNI).

The primary income of an institutional sector changes because of current taxes on income and wealth, social contributions and benefits, and other current transfers. The redistribution of income is shown on the secondary distribution of income account, which has disposable income as the balancing item. The use of income accounts shows how disposable income is spent on consumption or saved. Final consumption expenditure is only recorded for general government and households including NPISH. The balancing items are net saving for domestic sectors and current account balance on the external account.

The external account brings together all transactions involving both residents and non-residents, viewed from the perspective of the non-residents. The current external account records imports and exports of goods and services, compensation of employees to and from abroad, payments of property income and taxes to and from abroad, and other transfers to and from abroad.

• Accumulation accounts

The capital account is the first of the accumulation accounts. The account shows the change in net worth due to saving and net capital transfers. Furthermore, the account shows net acquisitions of non-financial assets in terms of net fixed capital formation (investment in produced non-financial assets), changes in inventories, and any net acquisition non-produced, non-financial assets (e.g land and intangible non-produced assets). The balancing item is net lending.

The link between the non-financial accounts and the financial accounts is established by the balancing item “net lending”. Net lending can be derived both from the capital account and from the financial transactions account (see below).

The financial account records the net acquisition (purchases minus sales) of financial assets and the net incurrence (issues minus redemptions) of liabilities. In table 11123, the balancing item in financial accounts is referred to as net financial transactions. Although net lending in theory is the same as net financial transactions, experience shows that statistical discrepancies occur between the two balancing items. One reason for discrepancies may be the large aggregates used in the quantification of the two balancing items. Even small errors in the aggregates can cause substantial discrepancies between net lending and net financial transactions.

• Other changes in assets account

Other changes in assets account records the change in balance sheets that are not due to transactions. The account records revaluations due to changes in market prices of assets and liabilities - holding gains and losses - and special events that change balance sheets - other changes in volume of assets. Examples of other changes in volume are natural disasters, write-offs of bad debts, but also changes in balance sheets caused by changes in classifications in source statistics.

• Balance sheets

The closing balance sheets show assets and liabilities at market prices at the end of each year for each of the five institutional sectors. In table 11123, the closing balance sheet for one year is equal to the opening balance sheets the next year. Two balancing items can be quantified: net financial assets and net wealth.

Net financial assets are calculated as the difference between financial assets and liabilities. Domestic sectors’ net financial assets towards the rest of world are calculated as the difference between foreign financial assets (e.g. foreign shares and bonds) and debt to foreign creditors. Net wealth for domestic sectors is calculated by adding net financial assets to non-financial assets.

The change in balance sheets during the accounting period (one year) is explained by net acquisition of non-financial assets, net lending and other changes in assets accounts (mainly holding gains and losses).

Contact

-

Statistics Norway's Information Centre