Slightly improved mood in manufacturing

Published:

Norwegian industrial managers report a slight increase in production in the fourth quarter. The growth comes from low levels after sharp falls in the level of activity in the first half of 2020 as a result of the corona pandemic. The general outlook for the first quarter of 2021 now testifies to cautious optimism.

- Full set of figures

- Business tendency survey for manufacturing, mining and quarrying

The business tendency survey for the fourth quarter of 2020 shows some growth in total output compared to the third quarter of 2020. There are producers of intermediate goods and consumer goods report higher production, while producers of capital goods continue to report a decline in production volume compared with the previous quarter.

After the total industrial employment has fallen in the first three quarters of 2020, as a result of the pandemic, the fall in employment has almost stopped in the 4th quarter of 2020. Higher employment is reported for producers of consumer goods in the 4th quarter, while producers of capital goods report lower employment. For producers of intermediate goods, employment is unchanged this quarter.

Figure 1. Production and employment for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Total volume of production | Average employment | |

| Q1-2011 | 50 | 55.35 | 53.88 |

| Q2-2011 | 50 | 55.91 | 54.72 |

| Q3-2011 | 50 | 55.06 | 54.23 |

| Q4-2011 | 50 | 54.21 | 53.61 |

| Q1-2012 | 50 | 53.22 | 53.64 |

| Q2-2012 | 50 | 52.47 | 54.09 |

| Q3-2012 | 50 | 52.04 | 54.27 |

| Q4-2012 | 50 | 51.02 | 53.14 |

| Q1-2013 | 50 | 49.74 | 52.29 |

| Q2-2013 | 50 | 50.83 | 52.39 |

| Q3-2013 | 50 | 52.69 | 51.59 |

| Q4-2013 | 50 | 54.00 | 50.58 |

| Q1-2014 | 50 | 54.43 | 49.87 |

| Q2-2014 | 50 | 52.97 | 49.55 |

| Q3-2014 | 50 | 51.34 | 49.84 |

| Q4-2014 | 50 | 50.44 | 49.04 |

| Q1-2015 | 50 | 48.11 | 45.13 |

| Q2-2015 | 50 | 46.21 | 41.01 |

| Q3-2015 | 50 | 46.82 | 39.11 |

| Q4-2015 | 50 | 47.49 | 39.39 |

| Q1-2016 | 50 | 48.62 | 41.07 |

| Q2-2016 | 50 | 49.08 | 42.19 |

| Q3-2016 | 50 | 47.36 | 41.98 |

| Q4-2016 | 50 | 47.57 | 42.60 |

| Q1-2017 | 50 | 49.68 | 44.90 |

| Q2-2017 | 50 | 50.01 | 47.46 |

| Q3-2017 | 50 | 50.37 | 49.80 |

| Q4-2017 | 50 | 51.32 | 50.56 |

| Q1-2018 | 50 | 52.38 | 50.31 |

| Q2-2018 | 50 | 54.17 | 51.12 |

| Q3-2018 | 50 | 55.50 | 52.68 |

| Q4-2018 | 50 | 56.02 | 54.29 |

| Q1-2019 | 50 | 55.89 | 55.22 |

| Q2-2019 | 50 | 55.23 | 55.02 |

| Q3-2019 | 50 | 52.85 | 52.15 |

| Q4-2019 | 50 | 49.63 | 48.61 |

| Q1-2020 | 50 | 45.66 | 44.69 |

| Q2-2020 | 50 | 45.08 | 43.00 |

| Q3-2020 | 50 | 48.30 | 45.55 |

| Q4-2020 | 50 | 51.89 | 48.90 |

Unchanged stock of orders and lower decline in new orders

The total stock of orders in manufacturing is in the fourth quarter about at the same level as in the previous quarter.

New orders from both the domestic and export markets fell in the fourth quarter, but the fall was less steep than in the third quarter. It is particularly producers of capital goods who report a decline in new orders, this applies to both the domestic and export markets. Growth in new orders at producers of intermediate goods from both markets was reported in the fourth quarter. For consumer goods, there are different developments for the two markets; here there is growth in the domestic market while there is a decline in new orders from the export market.

Figure 2. New orders received for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | New orders received from home markets | New orders received from export markets | |

| Q1-2011 | 50 | 57.30 | 53.46 |

| Q2-2011 | 50 | 56.91 | 50.61 |

| Q3-2011 | 50 | 54.89 | 48.16 |

| Q4-2011 | 50 | 55.02 | 47.26 |

| Q1-2012 | 50 | 55.13 | 48.07 |

| Q2-2012 | 50 | 52.57 | 48.85 |

| Q3-2012 | 50 | 49.80 | 46.57 |

| Q4-2012 | 50 | 49.07 | 44.63 |

| Q1-2013 | 50 | 48.19 | 45.00 |

| Q2-2013 | 50 | 48.87 | 47.97 |

| Q3-2013 | 50 | 50.65 | 52.41 |

| Q4-2013 | 50 | 50.75 | 54.97 |

| Q1-2014 | 50 | 50.08 | 54.85 |

| Q2-2014 | 50 | 49.86 | 53.02 |

| Q3-2014 | 50 | 48.23 | 49.56 |

| Q4-2014 | 50 | 46.30 | 46.16 |

| Q1-2015 | 50 | 44.44 | 43.54 |

| Q2-2015 | 50 | 43.08 | 42.17 |

| Q3-2015 | 50 | 43.16 | 43.33 |

| Q4-2015 | 50 | 44.36 | 44.09 |

| Q1-2016 | 50 | 45.88 | 43.27 |

| Q2-2016 | 50 | 46.84 | 42.68 |

| Q3-2016 | 50 | 47.47 | 43.72 |

| Q4-2016 | 50 | 49.23 | 45.88 |

| Q1-2017 | 50 | 50.29 | 47.93 |

| Q2-2017 | 50 | 49.92 | 49.39 |

| Q3-2017 | 50 | 51.50 | 50.27 |

| Q4-2017 | 50 | 53.74 | 51.93 |

| Q1-2018 | 50 | 53.91 | 54.24 |

| Q2-2018 | 50 | 53.37 | 55.56 |

| Q3-2018 | 50 | 53.61 | 55.21 |

| Q4-2018 | 50 | 54.22 | 53.89 |

| Q1-2019 | 50 | 54.83 | 52.82 |

| Q2-2019 | 50 | 54.39 | 51.69 |

| Q3-2019 | 50 | 51.43 | 49.69 |

| Q4-2019 | 50 | 46.63 | 46.72 |

| Q1-2020 | 50 | 42.22 | 45.01 |

| Q2-2020 | 50 | 41.85 | 45.21 |

| Q3-2020 | 50 | 45.32 | 46.83 |

| Q4-2020 | 50 | 47.88 | 48.48 |

There is still growth in the price level both in the home and export market for overall manufacturing. Producers of consumer goods and intermediate goods, in particular, report increased prices for sales to the domestic market. Prices in the domestic market for capital goods were unchanged compared with the third quarter of 2020. In the export market, price growth for intermediate goods, unchanged prices for capital goods and falling prices for consumer goods are reported.

Figure 3. Prices on products for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Prices on products at home markets | Prices on products at export markets | |

| Q1-2011 | 50 | 55.80 | 52.84 |

| Q2-2011 | 50 | 54.83 | 49.98 |

| Q3-2011 | 50 | 52.59 | 46.56 |

| Q4-2011 | 50 | 51.99 | 44.99 |

| Q1-2012 | 50 | 51.87 | 45.54 |

| Q2-2012 | 50 | 51.44 | 46.21 |

| Q3-2012 | 50 | 51.90 | 45.44 |

| Q4-2012 | 50 | 51.77 | 44.44 |

| Q1-2013 | 50 | 51.08 | 45.04 |

| Q2-2013 | 50 | 52.20 | 47.17 |

| Q3-2013 | 50 | 53.14 | 50.00 |

| Q4-2013 | 50 | 53.61 | 53.05 |

| Q1-2014 | 50 | 54.37 | 53.30 |

| Q2-2014 | 50 | 54.18 | 51.54 |

| Q3-2014 | 50 | 53.37 | 50.82 |

| Q4-2014 | 50 | 53.05 | 51.71 |

| Q1-2015 | 50 | 51.06 | 50.62 |

| Q2-2015 | 50 | 48.67 | 49.44 |

| Q3-2015 | 50 | 48.27 | 49.77 |

| Q4-2015 | 50 | 48.75 | 49.02 |

| Q1-2016 | 50 | 49.61 | 47.87 |

| Q2-2016 | 50 | 50.33 | 47.80 |

| Q3-2016 | 50 | 50.04 | 47.87 |

| Q4-2016 | 50 | 49.58 | 47.91 |

| Q1-2017 | 50 | 50.28 | 49.59 |

| Q2-2017 | 50 | 51.73 | 51.08 |

| Q3-2017 | 50 | 53.23 | 52.29 |

| Q4-2017 | 50 | 54.34 | 53.30 |

| Q1-2018 | 50 | 55.49 | 55.17 |

| Q2-2018 | 50 | 56.29 | 56.12 |

| Q3-2018 | 50 | 56.41 | 55.22 |

| Q4-2018 | 50 | 56.19 | 53.53 |

| Q1-2019 | 50 | 55.60 | 52.05 |

| Q2-2019 | 50 | 54.42 | 51.47 |

| Q3-2019 | 50 | 54.05 | 51.89 |

| Q4-2019 | 50 | 54.64 | 53.27 |

| Q1-2020 | 50 | 54.37 | 53.24 |

| Q2-2020 | 50 | 54.08 | 52.32 |

| Q3-2020 | 50 | 54.32 | 51.75 |

| Q4-2020 | 50 | 54.27 | 51.84 |

The pandemic intensified the downward trend in Norwegian manufacturing in 2020

The Business Tendency Survey's indicators from last year's surveys show that the decline in Norwegian industry started before the corona pandemic. The growth in total production stopped already in the 4th quarter of 2019. There was also a decline in new orders in both markets for all product types. The strong growth in oil investments through 2019 leveled off and the lack of growth in new oil and gas projects contributed to a fall in new orders for producers of capital goods. Low economic growth among Norway's most important trading partners, especially in the Eurozone and the United Kingdom, also contributed to lower new orders, especially for producers of intermediate goods.

Global pandemic and infection control measures reinforced and accelerated the downward trend in Norwegian manufacturing, which had already started before the pandemic. The sharp fall in oil prices in the wake of the global measures led to order droughts from the oil and gas industry, so that the fall in production and the decline in new orders became particularly steep for producers of capital goods. The package of tax measures for the oil and gas industry that was adopted in June and a gradual rise in oil prices contributed to the sanctioning of a number of new projects. This has contributed to a gradual decline in the fall in production and new orders for capital goods over the last two quarters. Falling oil prices and global stock market turmoil led to a sharp weakening of the Norwegian krone during the winter and spring. This may partly explain the clear price growth we have seen for intermediate goods in the export market throughout the year, and which has contributed to improved competitiveness for traditional export-oriented industry.

After reporting a fall in the level of activity in the first quarter, and unchanged production in the second quarter, producers of consumer goods have reported activity growth in the third and fourth quarters. The most important industry grouping within this type of product is the food and beverages group. Most manufacturers in this industry grouping have been relatively shielded from the consequences of infection control measures. In the aggregate sense, the abolition of deliveries to restaurants and other nightclubs has largely been replaced by more deliveries of food and beverages to the food chains. In addition, travel restrictions across national borders during the pandemic have led to Norwegians trading this type of goods to a much lesser extent in neighboring countries. This has increased the demand for domestic food and beverages.

Slightly positive expectations for the first quarter of 2021

The general outlook for the first quarter of 2021 is overall somewhat positive, and the proportion with an optimistic view for the coming quarter is higher than in the previous survey. Producers of intermediate goods and consumer goods have positive expectations, while producers of capital goods have become much less negative about the outlook for the coming quarter than they were in the previous survey. At the same time, a large proportion of industrial managers report that the ongoing pandemic continues to create uncertainty and help dampen optimism related to the general assessment of the outlook for the coming quarter. Industrial managers report that total production volume is expected to be at the same level as in the fourth quarter, while total industry employment is expected to fall again in the coming quarter. New orders from the domestic market is expected to increase somewhat, while a slight decline is expected in both new orders from the export market and total stock of orders.

Figure 4. General judgement of the outlook in next quarter for manufacturing.

| Turning point value | Smoothed seasonally adjusted | |

| Q1-2011 | 50 | 60.13 |

| Q2-2011 | 50 | 57.55 |

| Q3-2011 | 50 | 56.03 |

| Q4-2011 | 50 | 56.04 |

| Q1-2012 | 50 | 56.38 |

| Q2-2012 | 50 | 56.20 |

| Q3-2012 | 50 | 55.53 |

| Q4-2012 | 50 | 55.12 |

| Q1-2013 | 50 | 55.16 |

| Q2-2013 | 50 | 55.01 |

| Q3-2013 | 50 | 54.79 |

| Q4-2013 | 50 | 54.68 |

| Q1-2014 | 50 | 54.16 |

| Q2-2014 | 50 | 53.39 |

| Q3-2014 | 50 | 51.60 |

| Q4-2014 | 50 | 48.49 |

| Q1-2015 | 50 | 45.38 |

| Q2-2015 | 50 | 43.51 |

| Q3-2015 | 50 | 42.89 |

| Q4-2015 | 50 | 44.16 |

| Q1-2016 | 50 | 46.91 |

| Q2-2016 | 50 | 50.51 |

| Q3-2016 | 50 | 52.97 |

| Q4-2016 | 50 | 53.61 |

| Q1-2017 | 50 | 53.94 |

| Q2-2017 | 50 | 54.92 |

| Q3-2017 | 50 | 56.98 |

| Q4-2017 | 50 | 58.93 |

| Q1-2018 | 50 | 59.49 |

| Q2-2018 | 50 | 58.86 |

| Q3-2018 | 50 | 59.32 |

| Q4-2018 | 50 | 59.33 |

| Q1-2019 | 50 | 59.92 |

| Q2-2019 | 50 | 57.48 |

| Q3-2019 | 50 | 51.47 |

| Q4-2019 | 50 | 44.20 |

| Q1-2020 | 50 | 40.11 |

| Q2-2020 | 50 | 42.77 |

| Q3-2020 | 50 | 48.53 |

| Q4-2020 | 50 | 50.97 |

The industrial confidence indicator is positive and increasing slightly

The industrial confidence indicator in the third quarter was 3.1, seasonally-adjusted up from 2.0 in the previous quarter. The indicator has therefore now just exceeded the historical average of 2.9 for the first time since the second quarter of 2019.

The industrial confidence indicator is positive for both the majority of producers of intermediate goods and consumer goods, while it is still negative for producers of capital goods.

Values above zero indicate that total output will grow in the forthcoming quarter, while values below zero indicate that total output will fall. International comparisons of the industrial confidence indicator are available from Eurostat (EU), The Swedish National Institute of Economic Research and Statistics Denmark.

1 Industrial confidence indicator is the arithmetic average of the answers (balances) to the questions on production expectations, total stock of orders and inventories of own products (the latter with inverted sign).

Figure 5. Industrial confidence indicator¹

| Seasonally adjusted | Average 1990-2020 | |

| Q1-2011 | 9.1 | 2.9 |

| Q2-2011 | 8.5 | 2.9 |

| Q3-2011 | 5.7 | 2.9 |

| Q4-2011 | 6.0 | 2.9 |

| Q1-2012 | 9.0 | 2.9 |

| Q2-2012 | 6.4 | 2.9 |

| Q3-2012 | 0.8 | 2.9 |

| Q4-2012 | 4.9 | 2.9 |

| Q1-2013 | 1.4 | 2.9 |

| Q2-2013 | 1.0 | 2.9 |

| Q3-2013 | 6.3 | 2.9 |

| Q4-2013 | 8.0 | 2.9 |

| Q1-2014 | 6.5 | 2.9 |

| Q2-2014 | 6.1 | 2.9 |

| Q3-2014 | 1.9 | 2.9 |

| Q4-2014 | -1.7 | 2.9 |

| Q1-2015 | -3.6 | 2.9 |

| Q2-2015 | -9.3 | 2.9 |

| Q3-2015 | -6.4 | 2.9 |

| Q4-2015 | -8.2 | 2.9 |

| Q1-2016 | -6.6 | 2.9 |

| Q2-2016 | -3.0 | 2.9 |

| Q3-2016 | -3.6 | 2.9 |

| Q4-2016 | -0.5 | 2.9 |

| Q1-2017 | 1.6 | 2.9 |

| Q2-2017 | 2.5 | 2.9 |

| Q3-2017 | 3.8 | 2.9 |

| Q4-2017 | 6.5 | 2.9 |

| Q1-2018 | 6.9 | 2.9 |

| Q2-2018 | 8.8 | 2.9 |

| Q3-2018 | 9.2 | 2.9 |

| Q4-2018 | 8.9 | 2.9 |

| Q1-2019 | 7.9 | 2.9 |

| Q2-2019 | 6.0 | 2.9 |

| Q3-2019 | 1.0 | 2.9 |

| Q4-2019 | -0.7 | 2.9 |

| Q1-2020 | -16.9 | 2.9 |

| Q2-2020 | -9.2 | 2.9 |

| Q3-2020 | 2.0 | 2.9 |

| Q4-2020 | 3.1 | 2.9 |

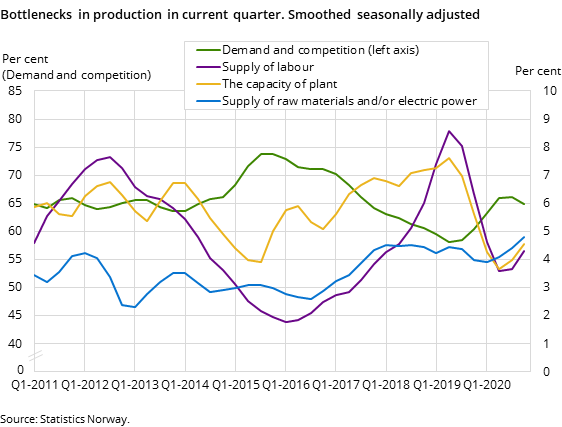

Weak demand limits production, but to a declining degree

Compared with the previous survey, there are now a somewhat lower proportion of industry leaders who highlight weak demand and strong competition as limiting production in the fourth quarter of 2020. At the same time, there is a low but increasing proportion of industry leaders who point out that a lack of machinery and plant capacity as well as qualified labor is a challenge.

The average capacity utilisation for Norwegian manufacturing is slightly higher than the previous quarter, and was calculated to 77.8 per cent at the end of the third quarter of 2020. The capacity utilisation is still lower than in 2019, and is well below the historical average of 80.0 per cent. International comparisons of average capacity utilisation are available from Eurostat (EU).

Figure 7. Capacity utilisation in per cent for manufacturing

| Smoothed seasonally adjusted | Average 1990-2020 | |

| Q1-2011 | 79.5 | 80.03 |

| Q2-2011 | 79.8 | 80.03 |

| Q3-2011 | 79.6 | 80.03 |

| Q4-2011 | 79.6 | 80.03 |

| Q1-2012 | 79.7 | 80.03 |

| Q2-2012 | 79.7 | 80.03 |

| Q3-2012 | 79.8 | 80.03 |

| Q4-2012 | 79.8 | 80.03 |

| Q1-2013 | 79.4 | 80.03 |

| Q2-2013 | 79.3 | 80.03 |

| Q3-2013 | 79.5 | 80.03 |

| Q4-2013 | 80.0 | 80.03 |

| Q1-2014 | 80.4 | 80.03 |

| Q2-2014 | 80.5 | 80.03 |

| Q3-2014 | 80.1 | 80.03 |

| Q4-2014 | 79.3 | 80.03 |

| Q1-2015 | 78.4 | 80.03 |

| Q2-2015 | 77.4 | 80.03 |

| Q3-2015 | 76.7 | 80.03 |

| Q4-2015 | 76.9 | 80.03 |

| Q1-2016 | 77.1 | 80.03 |

| Q2-2016 | 77.2 | 80.03 |

| Q3-2016 | 77.0 | 80.03 |

| Q4-2016 | 76.9 | 80.03 |

| Q1-2017 | 77.1 | 80.03 |

| Q2-2017 | 77.6 | 80.03 |

| Q3-2017 | 77.8 | 80.03 |

| Q4-2017 | 77.8 | 80.03 |

| Q1-2018 | 78.3 | 80.03 |

| Q2-2018 | 78.8 | 80.03 |

| Q3-2018 | 79.3 | 80.03 |

| Q4-2018 | 79.5 | 80.03 |

| Q1-2019 | 79.6 | 80.03 |

| Q2-2019 | 79.6 | 80.03 |

| Q3-2019 | 79.3 | 80.03 |

| Q4-2019 | 78.1 | 80.03 |

| Q1-2020 | 76.8 | 80.03 |

| Q2-2020 | 76.4 | 80.03 |

| Q3-2020 | 77.0 | 80.03 |

| Q4-2020 | 77.8 | 80.03 |

Timelines

The survey data was collected in the period from 4 December 2020 to 19 January 2021.

Contact

-

Edvard Andreassen

-

Ståle Mæland

-

Statistics Norway's Information Centre