Positive signals from the supplier industry

Published:

Norwegian industrial managers report a production level increase as well as growth in employment in the first quarter of the year. The positive trend is expected to continue in the second quarter, and especially for suppliers to the oil gas industry.

- Full set of figures

- Business tendency survey for manufacturing, mining and quarrying

The business tendency survey for the first quarter of 2019 shows a positive development in total industrial production compared to the last quarter of 2018. The growth is particularly strong among producers of capital goods who report increased production, but also producers of intermediate goods and consumer goods gives a positive evaluation of the activity level in the first quarter.

Growth in oil investments and increased contract volume for the supplier industry have given rise to a higher level of activity and the industrial leaders now report increasing growth in employment in the first quarter of 2019.

Figure 1. Production and employment for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Total volume of production | Average employment | |

| Q1-2010 | 50 | 50.02 | 44.54 |

| Q2-2010 | 50 | 51.33 | 45.43 |

| Q3-2010 | 50 | 52.03 | 46.99 |

| Q4-2010 | 50 | 53.23 | 50.45 |

| Q1-2011 | 50 | 55.35 | 53.88 |

| Q2-2011 | 50 | 55.91 | 54.71 |

| Q3-2011 | 50 | 55.06 | 54.23 |

| Q4-2011 | 50 | 54.22 | 53.63 |

| Q1-2012 | 50 | 53.23 | 53.64 |

| Q2-2012 | 50 | 52.47 | 54.07 |

| Q3-2012 | 50 | 52.02 | 54.27 |

| Q4-2012 | 50 | 51.02 | 53.16 |

| Q1-2013 | 50 | 49.77 | 52.29 |

| Q2-2013 | 50 | 50.83 | 52.37 |

| Q3-2013 | 50 | 52.63 | 51.59 |

| Q4-2013 | 50 | 54.01 | 50.59 |

| Q1-2014 | 50 | 54.51 | 49.97 |

| Q2-2014 | 50 | 52.99 | 49.73 |

| Q3-2014 | 50 | 51.21 | 49.89 |

| Q4-2014 | 50 | 50.47 | 48.98 |

| Q1-2015 | 50 | 48.24 | 45.12 |

| Q2-2015 | 50 | 46.23 | 41.02 |

| Q3-2015 | 50 | 46.64 | 39.07 |

| Q4-2015 | 50 | 47.59 | 39.41 |

| Q1-2016 | 50 | 48.77 | 41.11 |

| Q2-2016 | 50 | 49.06 | 42.17 |

| Q3-2016 | 50 | 47.37 | 42.01 |

| Q4-2016 | 50 | 46.87 | 42.73 |

| Q1-2017 | 50 | 48.12 | 44.96 |

| Q2-2017 | 50 | 49.14 | 47.40 |

| Q3-2017 | 50 | 50.42 | 49.67 |

| Q4-2017 | 50 | 51.45 | 50.61 |

| Q1-2018 | 50 | 52.33 | 50.51 |

| Q2-2018 | 50 | 54.28 | 51.19 |

| Q3-2018 | 50 | 55.48 | 52.49 |

| Q4-2018 | 50 | 55.98 | 54.05 |

| Q1-2019 | 50 | 56.81 | 56.07 |

New orders from the domestic market is increasing

The total stocks of orders have increased for the sixth consecutive quarter and it is particularly producers of capital goods and consumer goods that report growth in the first quarter. Increased new orders from the domestic market is the main reason for the growth in the volume of new orders, but also the export market report an increase in the total level of new orders in the first quarter of the year.

The results from the first quarter indicate that the more export-oriented part of Norwegian industry has a somewhat weaker development in demand. Producers of intermediate goods still report an increase of numbers of new orders from the export market, but fewer managers than in the fourth quarter of the last year report growth.

Figure 2. New orders received for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | New orders received from home markets | New orders received from export markets | |

| Q1-2010 | 50 | 46.91 | 47.59 |

| Q2-2010 | 50 | 50.77 | 51.68 |

| Q3-2010 | 50 | 53.53 | 53.37 |

| Q4-2010 | 50 | 55.36 | 54.24 |

| Q1-2011 | 50 | 57.29 | 53.43 |

| Q2-2011 | 50 | 56.91 | 50.57 |

| Q3-2011 | 50 | 54.89 | 48.14 |

| Q4-2011 | 50 | 55.03 | 47.25 |

| Q1-2012 | 50 | 55.12 | 48.07 |

| Q2-2012 | 50 | 52.56 | 48.86 |

| Q3-2012 | 50 | 49.80 | 46.58 |

| Q4-2012 | 50 | 49.08 | 44.63 |

| Q1-2013 | 50 | 48.18 | 45.01 |

| Q2-2013 | 50 | 48.86 | 47.98 |

| Q3-2013 | 50 | 50.65 | 52.41 |

| Q4-2013 | 50 | 50.77 | 54.93 |

| Q1-2014 | 50 | 50.07 | 54.84 |

| Q2-2014 | 50 | 49.86 | 53.06 |

| Q3-2014 | 50 | 48.23 | 49.57 |

| Q4-2014 | 50 | 46.30 | 46.10 |

| Q1-2015 | 50 | 44.46 | 43.53 |

| Q2-2015 | 50 | 43.19 | 42.23 |

| Q3-2015 | 50 | 43.20 | 43.34 |

| Q4-2015 | 50 | 44.33 | 44.05 |

| Q1-2016 | 50 | 45.86 | 43.13 |

| Q2-2016 | 50 | 46.85 | 42.47 |

| Q3-2016 | 50 | 47.35 | 43.53 |

| Q4-2016 | 50 | 49.11 | 45.75 |

| Q1-2017 | 50 | 50.23 | 47.94 |

| Q2-2017 | 50 | 50.03 | 49.53 |

| Q3-2017 | 50 | 51.52 | 50.38 |

| Q4-2017 | 50 | 53.56 | 51.89 |

| Q1-2018 | 50 | 54.03 | 54.35 |

| Q2-2018 | 50 | 54.01 | 55.78 |

| Q3-2018 | 50 | 53.92 | 55.21 |

| Q4-2018 | 50 | 53.81 | 53.65 |

| Q1-2019 | 50 | 54.92 | 52.10 |

Every quarter, for just over two years now, a price increase has been reported both in the home and export market. Hence the positive trend continues in the first quarter of 2019, with price growth in both markets for overall manufacturing. At the same time, industry leaders report a lower growth rate for export prices. Producers of consumer goods reported the highest growth rate for prices in both markets.

Figure 3. Prices on products for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Prices on products at home markets | Prices on products at export markets | |

| Q1-2010 | 50 | 46.72 | 45.52 |

| Q2-2010 | 50 | 49.06 | 49.27 |

| Q3-2010 | 50 | 51.36 | 51.55 |

| Q4-2010 | 50 | 53.53 | 52.68 |

| Q1-2011 | 50 | 55.80 | 52.84 |

| Q2-2011 | 50 | 54.83 | 49.98 |

| Q3-2011 | 50 | 52.60 | 46.55 |

| Q4-2011 | 50 | 51.99 | 44.99 |

| Q1-2012 | 50 | 51.88 | 45.55 |

| Q2-2012 | 50 | 51.44 | 46.21 |

| Q3-2012 | 50 | 51.89 | 45.44 |

| Q4-2012 | 50 | 51.78 | 44.44 |

| Q1-2013 | 50 | 51.10 | 45.04 |

| Q2-2013 | 50 | 52.18 | 47.17 |

| Q3-2013 | 50 | 53.12 | 50.00 |

| Q4-2013 | 50 | 53.63 | 53.07 |

| Q1-2014 | 50 | 54.40 | 53.30 |

| Q2-2014 | 50 | 54.19 | 51.53 |

| Q3-2014 | 50 | 53.40 | 50.79 |

| Q4-2014 | 50 | 53.12 | 51.67 |

| Q1-2015 | 50 | 51.09 | 50.61 |

| Q2-2015 | 50 | 48.66 | 49.46 |

| Q3-2015 | 50 | 48.20 | 49.77 |

| Q4-2015 | 50 | 48.77 | 49.05 |

| Q1-2016 | 50 | 49.64 | 47.91 |

| Q2-2016 | 50 | 50.22 | 47.74 |

| Q3-2016 | 50 | 49.88 | 47.81 |

| Q4-2016 | 50 | 49.77 | 48.00 |

| Q1-2017 | 50 | 50.44 | 49.67 |

| Q2-2017 | 50 | 51.51 | 50.96 |

| Q3-2017 | 50 | 53.06 | 52.17 |

| Q4-2017 | 50 | 54.27 | 53.48 |

| Q1-2018 | 50 | 55.60 | 55.29 |

| Q2-2018 | 50 | 56.48 | 55.92 |

| Q3-2018 | 50 | 56.54 | 55.05 |

| Q4-2018 | 50 | 56.38 | 53.69 |

| Q1-2019 | 50 | 56.56 | 52.59 |

Second quarter: Further growth is expected in manufacturing

The general outlook for the second quarter of 2019 is clearly positive for overall manufacturing, but the numbers of leaders that looks optimistic about the coming quarter is somewhat lower than in the previous survey. Optimism is also reflected in the indicator for future investments, where it is reported that approved investment plans are adjusted upwards. The positive picture is supported by expectations of growth in employment, new orders and total stocks of orders for the second quarter. If we look at the different product types, it is producers of capital goods who have the most optimistic outlook for the coming quarter.

Figure 4. General judgement of the outlook in next quarter for manufacturing

| Turning point value | Smoothed seasonally adjusted | |

| Q1-2009 | 50 | 40.17 |

| Q2-2009 | 50 | 43.98 |

| Q3-2009 | 50 | 47.54 |

| Q4-2009 | 50 | 50.26 |

| Q1-2010 | 50 | 53.24 |

| Q2-2010 | 50 | 56.05 |

| Q3-2010 | 50 | 59.01 |

| Q4-2010 | 50 | 61.00 |

| Q1-2011 | 50 | 60.13 |

| Q2-2011 | 50 | 57.55 |

| Q3-2011 | 50 | 56.03 |

| Q4-2011 | 50 | 56.04 |

| Q1-2012 | 50 | 56.38 |

| Q2-2012 | 50 | 56.19 |

| Q3-2012 | 50 | 55.53 |

| Q4-2012 | 50 | 55.13 |

| Q1-2013 | 50 | 55.15 |

| Q2-2013 | 50 | 55.01 |

| Q3-2013 | 50 | 54.81 |

| Q4-2013 | 50 | 54.70 |

| Q1-2014 | 50 | 54.15 |

| Q2-2014 | 50 | 53.36 |

| Q3-2014 | 50 | 51.63 |

| Q4-2014 | 50 | 48.52 |

| Q1-2015 | 50 | 45.37 |

| Q2-2015 | 50 | 43.45 |

| Q3-2015 | 50 | 42.96 |

| Q4-2015 | 50 | 44.21 |

| Q1-2016 | 50 | 46.88 |

| Q2-2016 | 50 | 50.42 |

| Q3-2016 | 50 | 53.04 |

| Q4-2016 | 50 | 53.85 |

| Q1-2017 | 50 | 54.23 |

| Q2-2017 | 50 | 55.06 |

| Q3-2017 | 50 | 56.72 |

| Q4-2017 | 50 | 58.28 |

| Q1-2018 | 50 | 59.08 |

| Q2-2018 | 50 | 58.83 |

| Q3-2018 | 50 | 59.12 |

| Q4-2018 | 50 | 60.49 |

The industrial confidence indicator for the first quarter of 2019 was 6.9 (seasonally-adjusted net figures). This is somewhat lower than the result from the previous quarter, but it still indicates growth in the production volume. A decrease of both producer of intermediate goods and consumer goods was the cause of the fall of the industrial confidence indicator. For producer of capital good the indicator remained more or less as the same level. Values above zero indicate that total output will grow in the forthcoming quarter, while values below zero indicate that total output will fall. International comparisons of the industrial confidence indicator are available from Eurostat (EU), The Swedish National Institute of Economic Research and Statistics Denmark.

1 Industrial confidence indicator is the arithmetic average of the answers (balances) to the questions on production expectations, total stock of orders and inventories of own products (the latter with inverted sign).

Figure 5. Industrial confidence indicator¹

| Seasonally adjusted | Average 1990-2019 | |

| Q1-2010 | 3.2 | 3.2 |

| Q2-2010 | 4.5 | 3.2 |

| Q3-2010 | 8.8 | 3.2 |

| Q4-2010 | 11.1 | 3.2 |

| Q1-2011 | 9.1 | 3.2 |

| Q2-2011 | 8.5 | 3.2 |

| Q3-2011 | 5.6 | 3.2 |

| Q4-2011 | 6.0 | 3.2 |

| Q1-2012 | 9.0 | 3.2 |

| Q2-2012 | 6.4 | 3.2 |

| Q3-2012 | 0.8 | 3.2 |

| Q4-2012 | 4.8 | 3.2 |

| Q1-2013 | 1.4 | 3.2 |

| Q2-2013 | 1.2 | 3.2 |

| Q3-2013 | 6.2 | 3.2 |

| Q4-2013 | 8.0 | 3.2 |

| Q1-2014 | 6.5 | 3.2 |

| Q2-2014 | 6.3 | 3.2 |

| Q3-2014 | 1.7 | 3.2 |

| Q4-2014 | -1.7 | 3.2 |

| Q1-2015 | -3.6 | 3.2 |

| Q2-2015 | -9.0 | 3.2 |

| Q3-2015 | -6.6 | 3.2 |

| Q4-2015 | -8.3 | 3.2 |

| Q1-2016 | -6.6 | 3.2 |

| Q2-2016 | -2.7 | 3.2 |

| Q3-2016 | -3.9 | 3.2 |

| Q4-2016 | -0.6 | 3.2 |

| Q1-2017 | 1.7 | 3.2 |

| Q2-2017 | 2.9 | 3.2 |

| Q3-2017 | 3.4 | 3.2 |

| Q4-2017 | 6.3 | 3.2 |

| Q1-2018 | 7.0 | 3.2 |

| Q2-2018 | 9.3 | 3.2 |

| Q3-2018 | 8.7 | 3.2 |

| Q4-2018 | 8.7 | 3.2 |

| Q1-2019 | 6.9 | 3.2 |

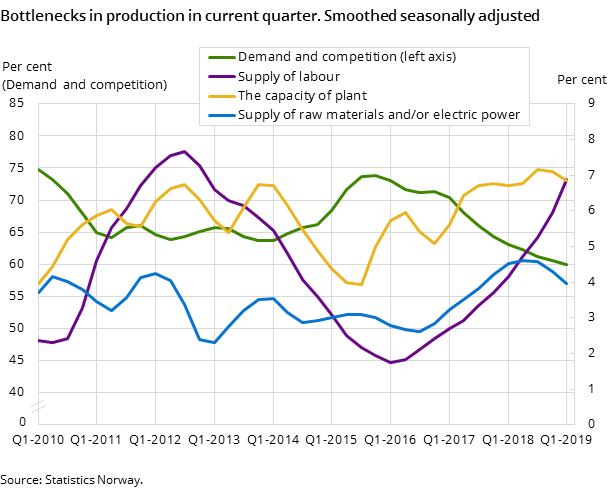

Lack of qualified labor force limits production

The share of managers reporting that weak demand and strong competition were limiting factors for production was reduced in first quarter of 2019. At the same time, there is an increase in the numbers of leaders who report that a lack of qualified labor force is a challenge in order to increase production further.

In figure 6 below shows how the indicators that represent resource shortage have increased since the bottom of 2016, while demand and competition represent a minor challenge for manufacturing.

The average capacity utilisation for Norwegian manufacturing has declined slightly, and was calculated to 79.3 per cent at the end of the first quarter of 2019.The corresponding figure for the fourth quarter was 79.5 per cent. This is below the historical average of 80.2 per cent. International comparisons of average capacity utilisation are available from Eurostat (EU).

Figure 7. Capacity utilisation in per cent for manufacturing

| Smoothed seasonally adjusted | Average 1990-2019 | |

| Q1-2010 | 77.1 | 80.16 |

| Q2-2010 | 77.8 | 80.16 |

| Q3-2010 | 78.5 | 80.16 |

| Q4-2010 | 78.9 | 80.16 |

| Q1-2011 | 79.5 | 80.16 |

| Q2-2011 | 79.8 | 80.16 |

| Q3-2011 | 79.6 | 80.16 |

| Q4-2011 | 79.6 | 80.16 |

| Q1-2012 | 79.7 | 80.16 |

| Q2-2012 | 79.7 | 80.16 |

| Q3-2012 | 79.8 | 80.16 |

| Q4-2012 | 79.8 | 80.16 |

| Q1-2013 | 79.4 | 80.16 |

| Q2-2013 | 79.3 | 80.16 |

| Q3-2013 | 79.5 | 80.16 |

| Q4-2013 | 80.0 | 80.16 |

| Q1-2014 | 80.4 | 80.16 |

| Q2-2014 | 80.5 | 80.16 |

| Q3-2014 | 80.1 | 80.16 |

| Q4-2014 | 79.3 | 80.16 |

| Q1-2015 | 78.4 | 80.16 |

| Q2-2015 | 77.4 | 80.16 |

| Q3-2015 | 76.7 | 80.16 |

| Q4-2015 | 76.9 | 80.16 |

| Q1-2016 | 77.1 | 80.16 |

| Q2-2016 | 77.2 | 80.16 |

| Q3-2016 | 77.0 | 80.16 |

| Q4-2016 | 76.9 | 80.16 |

| Q1-2017 | 77.1 | 80.16 |

| Q2-2017 | 77.6 | 80.16 |

| Q3-2017 | 77.8 | 80.16 |

| Q4-2017 | 77.8 | 80.16 |

| Q1-2018 | 78.3 | 80.16 |

| Q2-2018 | 78.8 | 80.16 |

| Q3-2018 | 79.3 | 80.16 |

| Q4-2018 | 79.5 | 80.16 |

| Q1-2019 | 79.3 | 80.16 |

Timelines

The survey data was collected in the period from 8 March to 23 April 2019.

Contact

-

Edvard Andreassen

-

Jan Henrik Wang

-

Statistics Norway's Information Centre