Content

Published:

This is an archived release.

Strengthened NOK lead to debt decline abroad

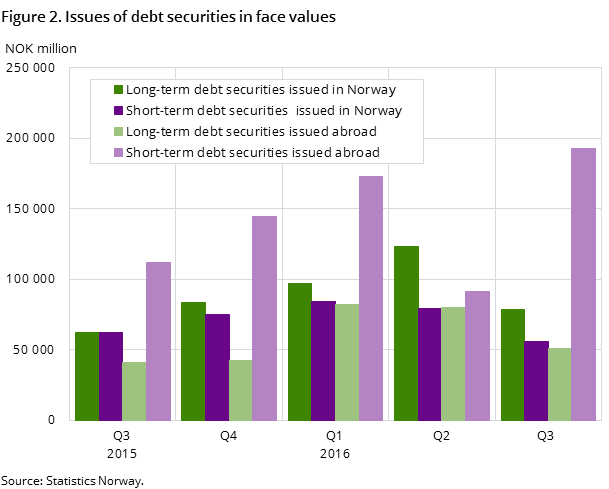

Outstanding amounts of debt securities issued abroad decreased by 2 per cent or NOK 31 billion during the 3rd quarter of 2016 while net issues of long- and short-term debt securities issued abroad remained positive. The debt reduction is due to a strengthening of the Norwegian kroner (NOK).

| 4th quarter 2015 | 1st quarter 2016 | 2nd quarter 2016 | 3rd quarter 2016 | |

|---|---|---|---|---|

| Stocks (market value) | ||||

| Shares (listed) | 1 827.2 | 1 733.7 | 1 812.9 | 1 875.1 |

| Shares (unlisted) | 433.4 | 433.2 | 427.6 | 422.1 |

| Long-term debt securities issued in Norway | 1 733.3 | 1 766.0 | 1 806.7 | 1 832.3 |

| Short-term debt securities issued in Norway | 170.4 | 182.3 | 177.0 | 161.2 |

| Equity certificates | 31.3 | 31.4 | 34.0 | 37.4 |

| Dividends/coupon payments | ||||

| Shares (listed) | 13.4 | 6.8 | 43.8 | 7.3 |

| Shares (unlisted) | 0.4 | 2.9 | 8.8 | 1.9 |

| Long-term debt securities issued in Norway | 10.1 | 10.9 | 21.4 | 8.1 |

| Short-term debt securities issued in Norway | 0.3 | 0.3 | 0.4 | 0.3 |

| Equity certificates | .. | 0.2 | 1.0 | .. |

It is mainly debt securities issued abroad by Norwegians which are impacted by the strengthening of the NOK during the 3rd quarter 2016. The face value of this debt totaled NOK 1776 billion by the end of the quarter. This corresponds to a 2 per cent reduction compared to the end of the 2nd quarter, and occurs despite Norwegians net issuing NOK 35 billion of debt securities abroad during the period. NOK 24 billion worth of these debt securities was issued as long-term debt securities, while NOK 11 billion worth was issued as short-term debt securities.

Debt securities issued in Norway

At the end of the 3rd quarter, the total face value of short- and long-term debt securities issued in Norway was NOK 1993 billion, approximately unchanged compared to the end of the previous quarter. The composition of the debt is somewhat changed, as there have been net issues of long-term debt securities during the period, while short-term debt securities have been net redeemed.

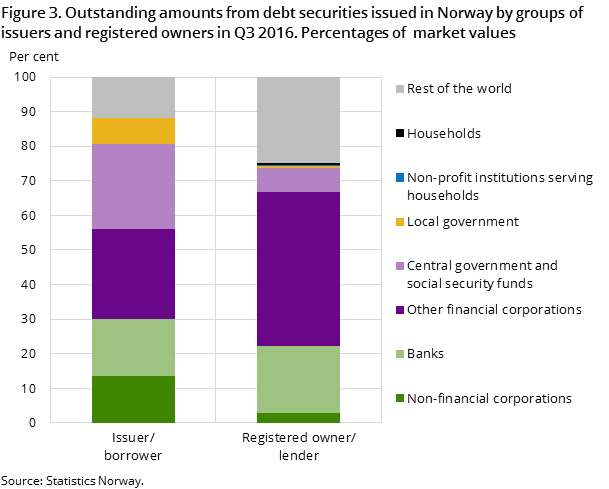

87 per cent of the debt was registered as issued by Norwegians at the end of the quarter.

Long-term debt securities distributed by types of guarantee

About 41 percent of the outstanding amount from long-term securities issued in Norway by the end of the 3rd quarter of 2016 was unsecured loans. By comparison, covered bonds made up 26 per cent of the total debt, while long-term debt securities guaranteed by the general government made up 21 per cent.

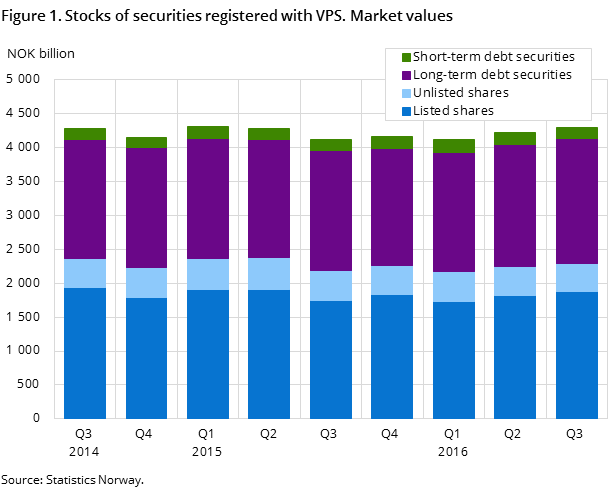

The share market

Net purchases of shares totaled NOK 23 billion during the quarter. Meanwhile, the total market value of shares rose by NOK 57 billion during the period, corresponding to a 2.5 per cent value increase. The total estimated value of shares registered with the Norwegian securities depository (VPS) added up to NOK 2302 billion at the end of the quarter. Listed shares made up 82 per cent of total market values and 78 per cent of net purchases, while the unlisted shares made up 18 and 22 per cent of the total values and net purchases respectively. A noticeable change during the period worth mentioning is that the central government’s share of total ownership in listed shares decreased by 2 per cent points. The central government now owns 32.5 per cent of the total market of listed shares.

Contact

-

Steven Chun Wei Got

E-mail: steven.got@ssb.no

tel.: (+47) 90 82 68 27

-

Ole Petter Rygvold

E-mail: ole-petter.rygvold@ssb.no

tel.: (+47) 47 27 23 62

-

Harald Stormoen

E-mail: harald.stormoen@ssb.no

tel.: (+47) 95 91 95 91